Summary

The question

remains as to whether the recent slight improvement in China’s outlook is

transitory or whether a sustained improvement can be seen. The US and Japanese

economies are giving more positive signals while Europe is stuttering and

facing further problems. Have commodity prices adjusted to the scenario? Will

the oversold situation resolve itself? Until these questions find resolution,

prices are likely to track sideways albeit with slightly higher support levels.

Aluminium – The more it changes, the more it

stays the same. High stocks, potentially weaker fundamentals, and a dearth of

meaningful net supply cuts remain the leading factors. Anticipated range $1,440

– $1,600.

Copper – Continues to be constrained by

proxy selling but fundamentals and stock movements starting to exert influence.

Possible restocking should underpin the market. Support seen around $4,700 but

selling pressure above $5,200.

Lead – Relatively low inventories and

buoyant auto and battery markets mean potential supply deficit should underpin

prices. Expected range for the quarter of $1,650 – $1,950.

Nickel – Disappointing first quarter and

the market appears bereft of positive influences. The effects of production

cuts are likely to be outweighed by the high level of stocks and the slumbering

stainless market. Range expected to be $8,000 to $9,500.

Tin – Lower exports from Indonesia,

sporadic production increases and generally stable consumption levels are

underpinning the market and tin is outperforming the other metals. Range likely

to be $15,400 to $17,000.

Zinc – The combination of the oversold

state of the market and the growing supply deficit resulting from production

cuts have stabilised prices and we look for a higher range of between $1,725

and $1,925 for this quarter.

Iron Ore &

Steel – Were the

recent price increases built on anything solid? It is difficult to envisage an

ongoing rally from here this quarter. The more likely view is one of

consolidation. Range expected to be $44 to $58.

Market overview

Outlook – The economic outlook has generally been bearish during the first quarter – the market has been fearful that China’s economy was slowing more than previously expected. The danger is that this would cause contagion. Weak Chinese demand would hit demand for imports; that weakness in turn would spread to those countries that exported to China – i.e. most of the rest of the world.

This fear hit commodity prices hard in the second half of 2015 and into early 2016 but the downward trends also led to prices becoming oversold – Chinese funds, banned from shorting equities, ended up shorting commodities as a proxy for the Chinese economy.

Fears that exceptionally weak commodity prices would lead to commodity companies defaulting on loans, triggering another debt crisis, added to the gloom and led to an oversold situation.

The exception was gold, which gained ground because of the increased fear factor. Once the markets picked themselves up off the floor in mid-January, the process of correcting the oversold situation started to unfold, leading to strong rallies across the metals and in oil. The fact gold prices have held up suggests that institutional investors may have become more interested in buying commodity baskets again.

The question now is whether this upside correction is merely a counter-trend move driven by short-covering or the start of a more sustainable rally. The jury is largely out on this – there are arguments for both sides and more data is needed before determining which holds the most sway. On balance, we expect the global economy to improve but there are likely to be numerous headwinds along the way.

As well, high stock levels in many of the metals may well prevent bull markets from getting started but some metals have better fundamentals than others and could therefore enjoy stronger rallies.

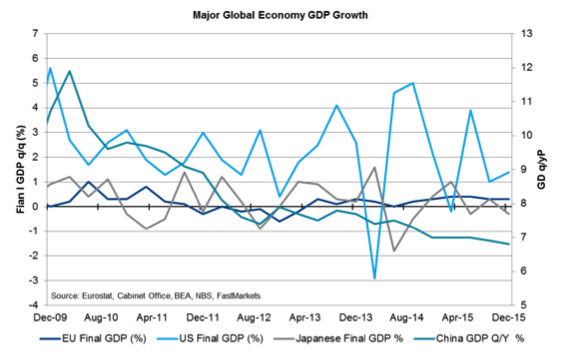

Growth in the global economy is generally weak, with fourth-quarter GDP at 1.4 percent in the US, 0.3 percent in the EU and -0.3 percent in Japan while China’s official GDP dipped to 6.8 percent in the fourth quarter last year.

All eyes on Chinese economic data – Compared with the double-digit growth in China during the super-cycle, the drop in China’s GDP is significant in percentage terms. But taking into account compound growth over the past decade and how large the Chinese economy now is, growth of 6.8 percent, if an accurate assessment, still means a lot more of everything is needed each year. This notion, we think, tends to be lost in all the gloom.

Assuming that falling prices have led to destocking, which is a finite phenomenon, the end of destocking and rising prices may well lead to restocking, which could give the economy a much-needed boost. The commodity markets are now on tenterhooks to see if that is starting to unfold.

The Chinese manufacturing PMIs – both the State and Caixin readings – have started to show signs of improvement. The state reading is pushing up above the 50 level, suggesting the manufacturing sector is expanding, while the Caixin reading of smaller companies has been trending higher since October, even if it is still below the 50 level. We would expect PMI data in the months ahead to be extremely influential on sentiment.

The Chinese CPI continues to trend higher and PPI, although still showing deflation, has improved in each month of this year – the Chinese economic super-tanker may be slowly turning round for the better.

If this trend develops, sentiment is likely to recover at a fast pace, we think, which in turn could lead to a restocking rally in commodities. But it is still a big ‘if’ as to whether China’s economy continues to recover – the signs we are seeing could turn out to be a false dawn.

Growth ex-China ticking along but still too slow – Although the commodity markets are fixed on China’s growth prospects, growth and financial stability in the rest of the world is also important and for once the markets are not experiencing any major financial – or geopolitical – crises as has so often been the case recently.

Despite this, growth is at best subdued. EU GDP has averaged 0.3 percent per quarter since mid-2013, Japan’s GDP per quarter has oscillated either side of flat and the US GDP has averaged around 2.25 percent over the same period on an annualised basis.

This overall low level of growth is not helping boost demand; neither is it generating the level of growth needed to provide exit velocity to set the global economy back to strong growth. With the IMF forecasting global growth of 3.2 percent this year, according to its latest forecast, the global economy is treading a thin line between recession and expansion.

The more dovish US monetary policy helps – Despite considerable fluctuations in Fed-speak, global markets have benefitted from a more dovish Fed stance, especially because chair Janet Yellen has tended to be more dovish than the rest of her team; ultimately, she is their boss.

The dovish stance has allayed fears in emerging markets (EM) that interest rates will rise sharply, which would make their repayment of foreign debt a bigger burden and impinge on their growth. The better outlook for EM economies has led to an inflow of investment into the region, halting the earlier capital flight that in turn had seen considerable EM currency weakness.

The rebound in commodity prices, especially oil, has also helped to boost growth in EMs. More recently, EM currencies have started to rebound, which we feel is a sign of health.

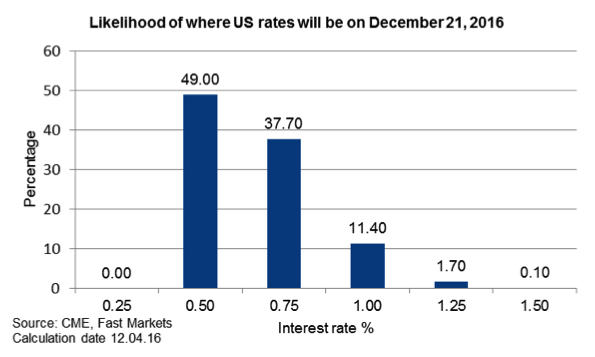

With global growth treading a fine line, it seems unlikely that the Fed will do anything that runs the risk of scuppering it. Although the market expects two interest rate rises this year, the Fed fund rates imply barely a 25-basis-point rise in 2016.

According to the 30-day Fed futures prices, there is a 49-percent likelihood that interest rates are still at 0.5 percent at the December FOMC meeting, a 37.7 percent likelihood of them rising to 0.75 percent and an 11.4 percent chance of them reaching one percent.

If there are no increases or just one of 25 basis points in US interest rates this year and market sentiment is still expects two rate rises, there is room for disappointment among dollar bulls. This could further weaken the dollar, which in turn could help underpin commodity prices. The longer the low interest rate environment holds, the less the risk of another EM tantrum.

As the chart of the dollar index shows, after a long run-up in the dollar, which accelerated in the second half of 2014 when the Fed started to talk about reining in quantitative easing (QE) and the return to a more normal monetary policy, it looks as though the dollar had discounted the first few rate rises.

Since the Fed first raised rates in December, the dollar index has not climbed; indeed, as expectations for the second rise have been kicked down the road, the dollar has fallen.

Further delays to rate rises may well make room for further dollar weakness. But with Japan and the EU still doing QE and pursuing negative interest-rate policies while the US’ next move is likely to be to raise rates, any pullback in the dollar index is likely to be relatively short-lived.

The danger is that if the fragile nature of the global economy, especially while it faces some political uncertainty over a potential Brexit and the rise of populism, overrides the Fed’s wish to keep ahead of the curve – inflation could then establish a foothold. This would be even more likely should oil prices rise sustainably if OPEC manages to freeze output.

A rise in inflation would likely be bullish for all commodities – it would lift commodity producers’ costs, which could bring about more production cuts, while for the likes of gold it could lift investment demand.

Recent timeline – Given how washed out commodity prices had become around the end of last year, we think the commodity sector had adjusted to the weak outlook. Even though the outlook showed little sign of improving earlier in the year, commodity prices started to rally – a lack of further selling pressure prompted some short-covering and some some bargain-hunting, which then attracted CTA-type buying, which fuelled the rebounds.

The rallies have been strong, averaging 23.7 percent. Aluminium gained the least, climbing 12 percent, while tin rallied the most, jumping 33.9 percent, and copper rose 18.8 percent. The approach at the end of the first quarter seemed to have prompted profit-taking; now the market is waiting to see what follows.

This fragile set-up means markets are vulnerable on both the upside and downside. Restocking could fuel a rally while any economic crisis – a hard landing in China, equity market corrections, a renewed Greek crisis – or a political crisis (Brexit, OPEC factions, EU Immigration, a shock US election result) could lead to another downward spiral in commodity prices.

On balance, we feel the slowdown in China is being orchestrated and is all part of the plan to transform the old economy to a new model that will be geared up to feed off consumer spending. Given the control that policymakers still have in the economy, we would be surprised by a hard landing although in a crisis the unexpected can unfold too quickly to be managed.

The One Belt One Road project was announced some years ago; as the planning stages are completed, more projects should start. When that happens, we would expect order books to fill up, which is bound to be bullish for commodities. It is noteworthy that iron ore and steel prices are rallying more than expected in recent months, which could be a sign that industry is receiving more orders.

As well, while the anti-corruption clampdowns, which have often been blamed for delaying infrastructure projects, run their course, improved confidence may well see more infrastructure projects get off the ground, especially because local governments have been allowed to raise money via municipal bonds.

The Chinese government’s plan to change the focus of the economy was never going to be a seamless operation; the turnaround would take time and be disruptive and it may still have a lot further to run. But if the commodity markets have reacted to the shock adjustment and have overshot on the downside in the process, there may well be room for some longer-lasting counter-trend moves while some of the changes start to bear fruit.

Outlook – After becoming oversold around the end of the year, it looks as though the metals have undergone an adjustment prompted by short-covering that led to some fund-buying and perhaps some bargain-hunting before profit-taking has set in more recently. The question now is whether the global economy, led by China, recovers enough to warrant users of metal to restock.

Given the significant production adjustments and strategic buying in recent quarters and a handful of encouraging signs and reports from Asia that demand is improving, there seems a good chance that the fundamentals will improve. Where stocks of metal are not too high or too liquid, there may be room for higher prices, especially because restocking can cause consumers to chase prices higher. Rising price may also attract more fund-buying.

On balance, we are not too bullish but we think demand may improve somewhat, which will complement the supply restraint and lead to some upside pressure on prices. Still, the whole dynamic is likely to remain fragile.

Given this, we would expect nervousness about the outlook to prompt producer selling into price strength, which is likely to cap the upside. So we are mildly bullish and expect sideways-to-higher range-trading over the medium term.